SJPP Skim Jaminan Kerajaan MADANI

Sekiranya anda seorang usahawan SME yang sedang mencari pembiayaan untuk mengembangkan perniagaan, kini Syarikat Jaminan Pembiayaan Perniagaan (SJPP) telah memperkenalkan Skim Jaminan Kerajaan MADANI (GGSM) – sebuah inisiatif penting yang direka khusus untuk membantu syarikat mendapat akses kepada modal dengan lebih mudah, kadar faedah yang rendah, dan proses kelulusan yang cepat. Dengan adanya skim jaminan […]

Struggling with Cash Flow? Here’s How SMEs Can Unlock Financial Support

Cash flow challenges are one of the biggest hurdles faced by SMEs in Malaysia. Late payments from customers, high operating costs, or unexpected expenses can leave even profitable businesses struggling to stay afloat. If left unaddressed, poor cash flow management can disrupt daily operations and slow down growth. Fortunately, there are effective financing solutions that […]

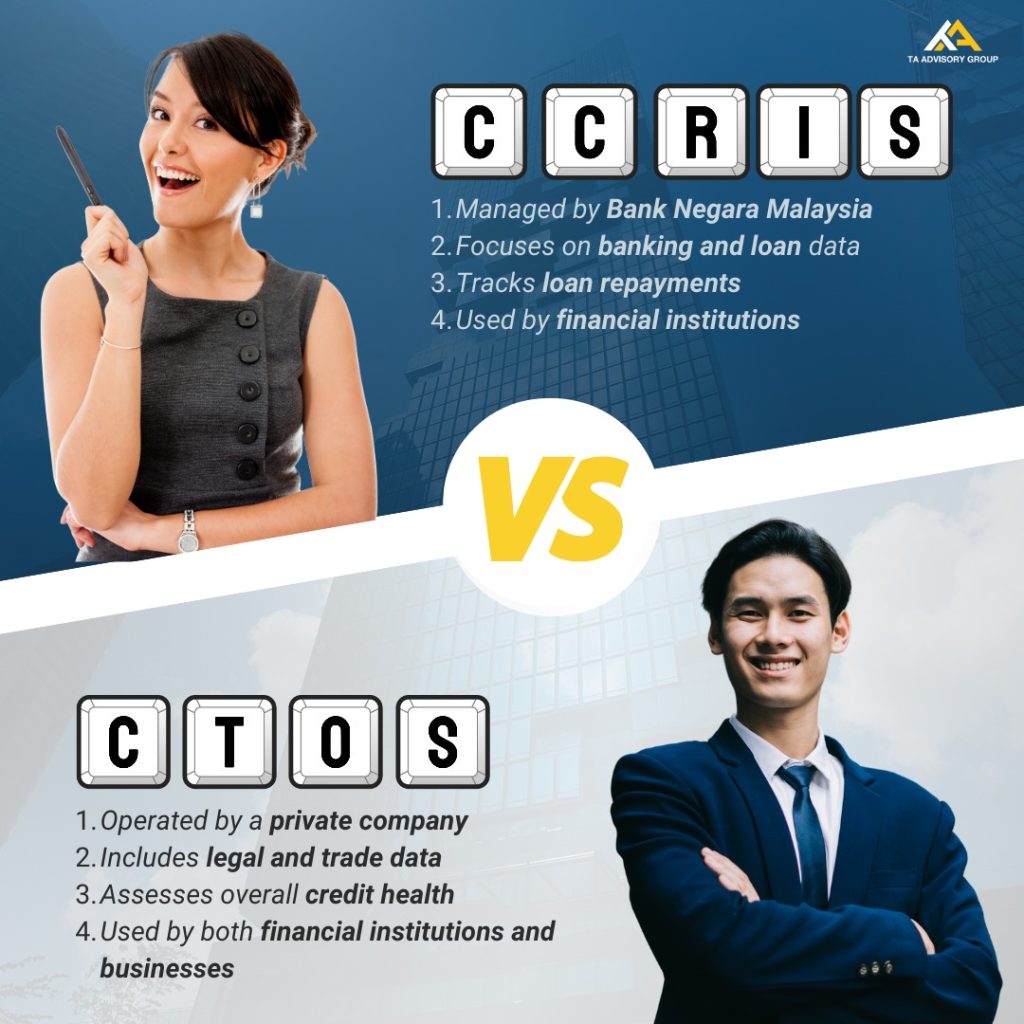

CCRIS vs CTOS

When applying for a business loan in Malaysia, one of the first things financial institutions will check is your credit profile. Two of the most important reports lenders rely on are CCRIS (Central Credit Reference Information System) and CTOS. Understanding the difference between the two can help you take control of your financial health and […]

3 Tips to Make Your Bank Statement Look Profitable for Loan Approval

When you apply for a business loan in Malaysia, your bank statement is one of the first documents lenders will analyze. Why? Because it reflects your business’s true financial health. A strong, well-managed bank statement can significantly improve your chances of securing approval for loans and financing programs — including government-backed schemes such as the […]

4 Tips to Boost Your Credit Score

Securing a business loan in Malaysia is not just about applying — it’s about building the right financial foundation. Whether you’re an SME owner preparing for expansion or a startup looking to scale, your financial profile plays a critical role in determining loan approval. At TA Advisory, we help SMEs prepare for funding opportunities, including […]

Secure Your Business Loan with TA Advisory: Key Steps for SME Success

Looking to secure a business loan in Malaysia? Whether you’re running an SME or planning for expansion, getting loan approval can sometimes feel like a challenge. But with the right preparation and guidance, your chances of success increase significantly. At TA Advisory, we specialize in helping SMEs access financing solutions, including the Government Guarantee Scheme […]

Need Funds Urgently for Your SME? Here’s How to Get Fast, Flexible Financing

For many SMEs in Malaysia, maintaining healthy cash flow can be a constant challenge. Whether it’s to cover operational expenses, expand your business, or take advantage of new opportunities, having quick access to funding is crucial. At T Advisory Group, we understand the urgency. That’s why we provide fast, flexible, and collateral-free SME financing solutions […]

SME Loan vs. Using Your Own Capital – Which is Better for Growing Your Business?

If you are an entrepreneur or SME owner in Malaysia, one of the biggest decisions you will face is whether to use your own money or apply for a SME loan to expand or sustain your business. While self-funding offers complete control, it can quickly drain your cash reserves and limit your growth potential. On […]

Exciting News for Malaysian Business Owners ❗

If you’re a Malaysian business owner looking for new opportunities to grow, the Government Guarantee Scheme Malaysia (GGSM) could be your game-changer. Launched in 2023 by SJPP and proudly owned by the Ministry of Finance Incorporated, GGSM is designed to empower SMEs and MSCs with essential financing assistance that can fuel long-term success. 💡 What […]

Grab Government Financial Support for Your Business Today

Looking to expand your business but facing financial roadblocks? With the Government Guarantee Scheme MADANI (GGSM), SMEs across Malaysia can now access flexible financing solutions with ultra-low interest rates and minimal barriers. At T Advisory Group, our dedicated team is here to help you secure funding of up to RM 20 million through this groundbreaking […]