When applying for a business loan in Malaysia, one of the first things financial institutions will check is your credit profile. Two of the most important reports lenders rely on are CCRIS (Central Credit Reference Information System) and CTOS. Understanding the difference between the two can help you take control of your financial health and increase your chances of loan approval — especially when applying for government-backed financing such as the Government Guarantee Scheme MADANI 2 (GGSM 2025).

🔹 What is CCRIS?

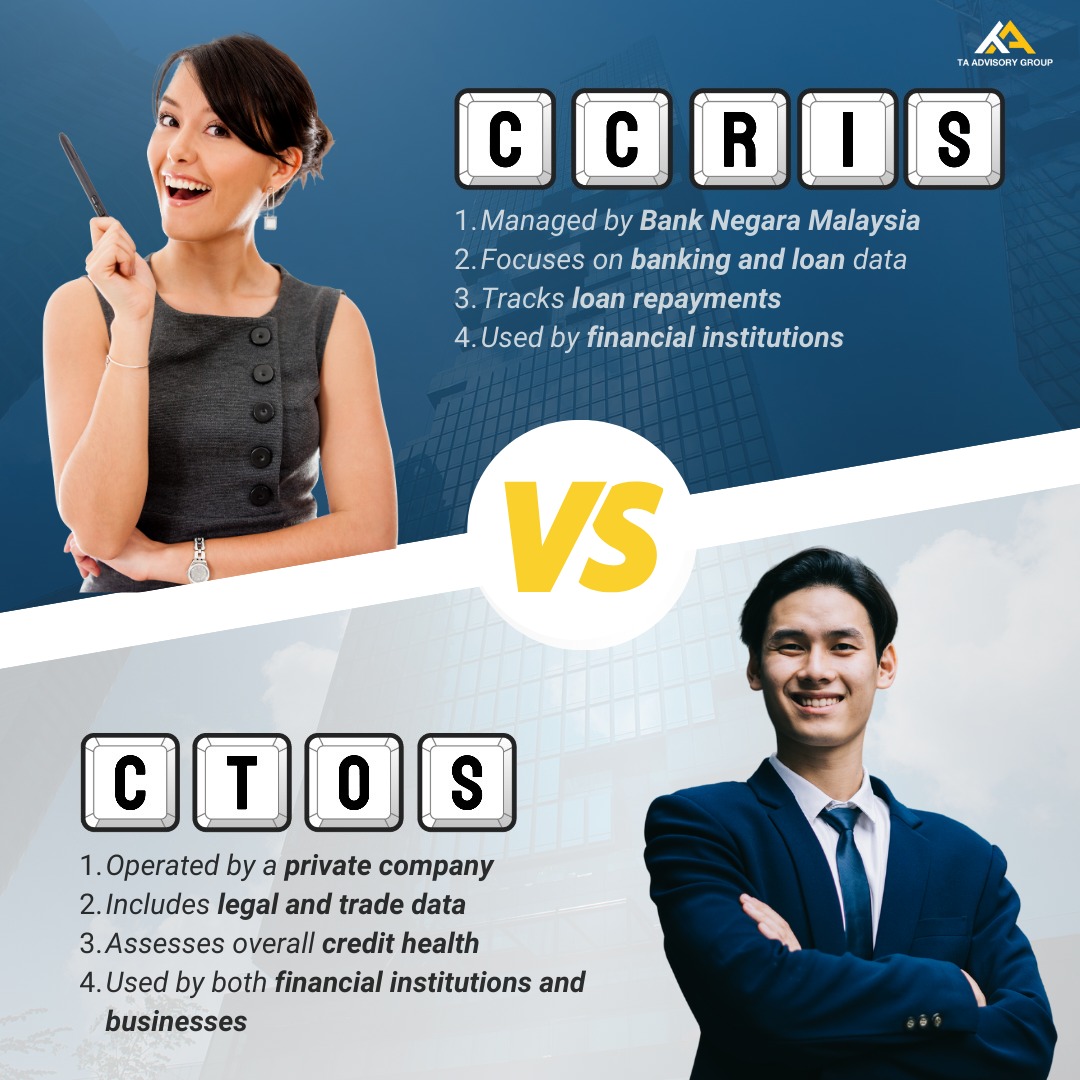

The Central Credit Reference Information System (CCRIS) is managed by Bank Negara Malaysia (BNM). It collects and compiles your credit information from banks and financial institutions. Key features include:

- Tracks all banking and loan data

- Monitors loan repayment behavior

- Provides lenders with insights into your credit history

- Exclusively used by financial institutions

CCRIS is crucial because banks use it to assess whether you are a reliable borrower. A poor repayment record in CCRIS may hurt your loan chances, but a consistent track record will boost your credibility.

🔹 What is CTOS?

Unlike CCRIS, CTOS is operated by a private company and provides a broader credit report. It does not just cover banking data, but also includes:

- Legal and trade information (e.g., litigation, company registration, trade references)

- A more comprehensive assessment of overall credit health

- Information used not only by banks, but also by businesses and service providers

This means CTOS gives a wider picture of your financial standing, combining both formal financial data and external factors like trade references and legal history.

🔑 Why Does This Matter for SMEs?

When applying for an SME loan — whether from a bank or through programs like GGSM 2025, which offers up to 90% government guarantee and financing up to RM20 million — both CCRIS and CTOS play a role in the approval process.

A healthy CCRIS shows strong repayment discipline, while a positive CTOS demonstrates your overall business reliability. Together, they form a complete picture for lenders and can significantly influence approval rates.

How TA Advisory Group Can Help

At TA Advisory, we specialize in helping SMEs prepare for financing by:

- Reviewing CCRIS & CTOS reports

- Advising on strategies to improve credit health

- Guiding SMEs through the loan application process

- Assisting with government-backed facilities such as GGSM 2025

You can explore more about our role as trusted advisors on our about us page, or see how our services can strengthen your business financial foundation.

📞 Ready to Improve Your Credit Profile?

Don’t let uncertainty hold your business back. Take proactive steps today:

👉 Visit our contact page to schedule a free consultation.

👉 Stay updated with the latest SME loan tips and financial insights by following our official TA Advisory Facebook page.